Banking on Ubuntu

TL;DR

Banking CIOs may know about Ubuntu, and be vaguely aware of Canonical, but I’d be surprised if many could explain the difference in commerials versus Red Hat. Meanwhile engineering teams are content to stick with what they have in a combination of clinging to the past and seeking some mythical homogeneity. OpenStack might give Canonical the break out opportunity it’s been waiting for, but it’s a risky bet given the parlous state of that project (and some smart recent game play by Red Hat).

Background

It’s coming up on a year since I left the world of banking to join CohesiveFT, but I took a trip back to my old world to attend a banking CTO conference last week. One of the speakers was Mark Shuttleworth from Canonical, which got me thinking about (the lack of) adoption of Ubuntu in financial services.

My personal experience of Ubuntu

I switched to Ubuntu myself about 5 years ago. I’d been a relatively early adopter of Red Hat back in 1996, but when it came to doing stuff in the cloud everybody was using Ubuntu, and I could see why – it was easy and it worked. These days I reach for the latest Ubuntu LTS as first choice whenever I need a Linux box or VM. Ubuntu is also the basis of what we do at CohesiveFT.

It was a little later, when I got to know Simon Wardley (who worked for Canonical at the time), that I learned of Canonical’s different approach to monetising Linux and related open source. This seemed like a way to deal with the myth of software support. It’s also a (somewhat) scale free approach, decoupling support costs from the size of deployments.

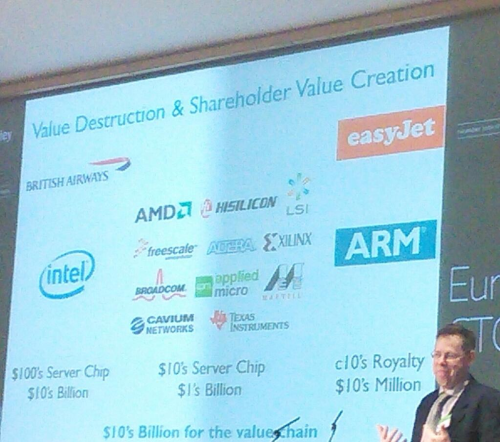

What Canonical are doing fits into what I’ve previously labelled ‘Internet Alchemy’ – a disruptive move that turns somebody else’s pile of gold into their pile of nickels. In their recent book ‘The Second Machine Age‘ Andrew McAfee and Erik Brynjolfsson refer to this as analogue dolars turning into digital pennies – it’s not a perfect analogy for disruption of one generation of IT for another, but it fits. At the same event ARM’s CTO Mike Muller made similar observations. The key point is how much value gets put back into consumer surplus:

Linux at banks

Linux started to find its way onto unofficial boxes under desks around 2000 (I had one), and found its way onto production systems a few years later. x86 hardware became too compelling from a performance/price point of view, but many teams didn’t want Windows. Red Hat stepped into the void, and soon afterwards Enterprise Linux (EL) came along to be a slower moving target for adoption and support. It’s telling that Red Hat essentially owns the words ‘Enterprise Linux’.

Banks push systems harder than many other users, and I’ve seen Linux pushed to breaking point a number of times (with the thing that was breaking usually some I/O driver). That’s when support becomes crucial – especially when things are already in production. Red Hat cornered that support in two ways – firstly they signed up all of the banks adopting Linux as customers, and secondly they worked with all of the software vendors preferred by those banks to have RHEL as part of their official support matrix. There are essentially three reasons why banks pay for RHEL licenses:

- Support of the OS itself

- Near ubiquity of ISV support for the platform

- Open source indemnity

The top down sell

Linux was a reasonably easy top down sell because the hardware was so much cheaper than RISC based servers (even if they were bundled with their proprietary Unix flavours).

Today’s tech savvy CIO [1] will have heard of Ubuntu. They may even use it for personal stuff. They might just be aware of Canonical as the commercial vehicle behind Ubuntu, but it’s unlikely that they know the difference of approach versus Red Hat.

The top down problem is one of ignorance, and often a lack of access to deal with that ignorance.

Long term Canonical might be able to pull off a domino run – once one CIO adopts the others in the club follow. It’s likely to start with OpenStack environments running in house apps (that don’t get caught in the ISV support matrix).

The bottom up sell

The banks still have Unix (rather than Linux) engineering teams – in part because there’s a whole ton of proprietary Unix still in production. These guys create internal distros – taking stuff out that might be risky in the production environment, and putting stuff in that’s part of the enterprise operation scene (monitoring, security agents etc.). This becomes problematic with support, because ISVs claim that the banks aren’t really running RHEL when things go wrong.

A typical part of the *nix environment is that systems get pushed from golden sources on a frequent (daily) basis. Operations teams have gotten out of the business of managing snowflakes – but that’s been swapped for piste bashing, every slope is different, and they need to be groomed every day before start of play.

In his talk Mark frequently referred to Solaris as a label for the old world. The trouble is that early internal Linux builds were made to look like SunOS, because the Unix guys had stuck with that when Solaris came along. It’s only in recent years that a combination of skills issues (the new kids just didn’t grok SunOS) and ISV issues (where’s /opt?) have forced a refresh of builds to look something like a contemporary Linux.

The SunOS era guys are still in charge. They resisted Solaris when that came along. They resisted RHEL when that came along. Care to guess what they think of Ununtu? These aren’t the people writing white papers about how a switch to Canonical could save the company a ton of money.

Oneness

One thing that banking CIOs and Unix engineers can usually agree on is a fanatical zeal to have just one of everything. One type of hardware running one operating system using one sort of database etc.

Of course that’s not how things work out in real life. Corner cases creep in, exceptions are made, and heterogeneity takes hold. And this is what makes everything so expensive.

Two flavours of Linux == twice the engineering and support costs. Simple!

Even if Canonical Ubuntu is free then it’s not worth the effort to adopt it because RHEL will still be needed for all of the ISV stuff that depends on it.

Or so the story goes… I’ve been guilty myself in the past on this one – sticking with a proprietary full fat application server stack rather than embracing Tomcat for low end stuff. It did actually make economic sense for a while, but circumstances changed and it took too long to re-evaluate and reposition.

Does OpenStack change the game?

Maybe.

If OpenStack gets its act together[2] and really is the Linux of cloud then it’s exactly the opportunity that Canonical need – the driver of that re-evaluation and repositioning.

The Canonical support model of OpenStack is straightforward and seems both reasonable and fair (though I am left wondering why Mark has this stuff in his slides, but I can’t find it on the web to link to here?[3]).

It’s clear though that Red Hat aren’t being idle in the space. Their recent move with CentOS means that they have a free at the point of consumption route to market for their own flavour of OpenStack, with a licensed version there for those who feel the need to pay for support.

Notes

[1] Banking CIOs aren’t all technically illiterate – though that can be a problem. Many CIOs come from a software dev leadership background, but it’s (sadly too) fashionable to concentrate ‘on the business’ and ‘be a manager rather than a technologist’. The present trend in technology companies of having strongly technical (rather than sales) leadership hasn’t yet crossed over to financial services. The hard part is that technical skills get washed out – three years off the coal face might as well be a lifetime, as the industry and state of the art moves on.

[2] Right now that seems like a big if. Simon Wardley has the issues covered in The trouble with OpenStack, and I wrote myself recently about some of the quality issues and infighting amongst contributors.

[3] Perhaps part of Canonical’s problem with obscurity is that there’s no transparency on what they do charge for their services.

Filed under: technology | 1 Comment

Tags: banking, Canonical, cloud, EL, Linux, OpenStack, Red Hat, RHEL, Ubuntu

One Response to “Banking on Ubuntu”