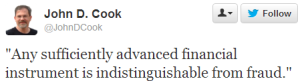

Indistinguishable from fraud

I came across this tweet yesterday:

It was timely, as I was in the midst of sorting out a foreign exchange transaction that had gone wrong. I’d sent $250 to a recipient in the US, and only $230 had shown up in their account (and then their bank had charged them $12 for the privilege of receiving it). Somehow $20 had gone missing along the way.

The payments company had this to say on the matter:

I would also not be happy if $20 was missing from a transfer and I apologise for the situation.

This does, unfortunately, happen from time to time. Normally it is a corresponding bank charge charged en route, which we will refund.

I responded:

Whilst your explanation might fit something off the beaten path there’s no good reason for $20 to vanish into the ether on a well worn road like GBP/USD. My first guess would be somebody fat fingered this at some manual data entry stage (I’d like to hope that you have a straight through process, but I expect it isn’t), my second guess would be fraud.

and they’d said in return:

I assure you that our instruction was for the full amount and there is no fraudulent activity.

At the moment our payments to the USA are via the SWIFT network and as they are international cross border payments there can be correspondent banks involved that we have no control over.

So there we have it – some random correspondent bank along the payment chain treating itself to $20 is completely fine – that’s not fraud. Or maybe two banks helped themselves to $10 each? Nobody seem to know, and nobody seems to care – cost of doing business.

I wouldn’t call out international payments and foreign exchange (FX) as being ‘advanced financial instruments’, but I do know that it’s mostly a disgraceful shambles. If I add up the total fees, charges and spreads associated with this simple transaction then it comes out at almost $50, or around 20% of my transaction. That’s just utterly ridiculous for squirting a few bits from a computer in the UK to a computer in the US. It makes what the telcos charge for SMS seem reasonable (which it is not).

It’s no wonder that developing economies, and particularly small firms within developing economies, are struggling to engage in international commerce. If it’s this hard and expensive to move money along what should be the trunk road of UK/US then I dread to think what it’s like trying to do business off the beaten path (such as to or from Sub-Saharan Africa). I’m pleased to see that the World Bank is doing something about this by investing in payments companies that route around some of the greedy mouths to feed by taking advantage of low cost national payments networks (like ACH in the US, Faster Payments in the UK and corresponding systems elsewhere). Of course SWIFT still gets their pound of flesh (for the time being), but perhaps as we get better netting over that network the toll will be minimised.

Filed under: could_do_better, grumble | 3 Comments

Tags: banking, charges, fees, financial services, fraud, FX, international, payments, spreads

Clarke’s third law applied to finance. Ultimately, it’s all magic (of the charlatan kind, not the real thing). Have you tried bitcoin transactions yet? In practice it is startlingly good.

I like lots of things about bitcoin, just not how it actually works (by design, and in the real world [IanG is like a real life version of one of the Crytonomicon characters, and knows a thing or two about how this stuff works out having got in some scrapes over eGold]). The botnet bad actor problem has moved on to becoming an ASIC maker bad actor problem, but a slightly different bunch of bad actors doesn’t much help.

I should give my friend Simon the final word ‘the pure brilliance and horror of bitcoin‘

Good lord, that’s all a bit inflammatory. What I meant was, have you actually engaged in a transaction using bitcoin. If you haven’t – you should.