Snakes!

It’s been quiet around here, as the new job has been keeping me busy, and I just took a couple weeks off to visit friends in the US. I have some good posts saved up though, which I hope to get out over the next week or two.

On my second to last day in the States we took the kids for a walk in Scotts Run Nature Preserve. The kids had been there a week or so earlier, and had loved splashing around in the stream. As they were repeating the experience my friend Gav noticed this pair:

A moment later he spotted this one right near to the kids. His 9yr old daughter identified it as a Copperhead, and it seems she was completely right.

A moment later he spotted this one right near to the kids. His 9yr old daughter identified it as a Copperhead, and it seems she was completely right.

Just as I was taking that photo I heard a yell from my wife to join them ahead. When I got there this one was making its way up stream and towards the far bank (in the shallows where there were concrete stepping stones), we think it’s a (Black) Northern Water Snake:

Three different types of snakes in about as many minutes. We found another snake (sadly caught in fishing line) as we make our way along the stream towards its joining with the Potomac:

All in all a much more interesting walk than I was expecting. Back to my usual rumblings and grumblings about technology in the next few days..

All in all a much more interesting walk than I was expecting. Back to my usual rumblings and grumblings about technology in the next few days..

Filed under: travel | 1 Comment

Tags: black water snake, copperhead, northern water snake, racer, snakes

Eyeballs not devices

Too many devices

I seem to accumulated a proliferation of devices recently that want to have SIM cards in them for mobile data:

- Personal laptop (well actually a tablet, but not in the way that people use that label these days)

- Work laptop

- iPhone (not just data)

- Android phone (could be not just data, but I don’t use it for calls)

- Galaxy Tab

- MiFi

This is one of the reasons I ended up ordering a WiFi only iPad 2 (the others being uncertainty over carrier locking to AT&T for US GSM models, and the lack of HSDPA) – I just couldn’t be doing with another telco contract in my life.

Let’s run through that list again with an eye on the contracts:

- Personal laptop – old style Vodafone PAYG SIM (£15 for 1GB, credit lasts forever provided it’s used every 6 months). Basically there for emergences.

- Work laptop – presently empty

- iPhone – £40/month Vodafone contract with 900 minutes, unlimited texts, 750MB data. I mostly got this for roaming in Europe, where I get 25MB data per day, and calls for up to an hour for 75p.

- Android phone – £5.11/month Three ‘SIM only Internet‘ contract for 2GB data

- Galaxy Tab – £15.50/month Three data plan for 15GB data (I should probably switch this for another SIM only Internet plan)

- MiFi – presently empty

I could ask why Three charge a very reasonable £5.11 for 2GB of data on a plan intended for a smartphone, and lots more for other ways of consuming data from their network, but the confusopoly of telcos and data pricing has been done to death elsewhere. What did make me really angry this week is finding out that I’ve been stung for £5 just trying out the new hotspot feature on the iPhone (I used 95Kb of data, but got charged for a 500MB allowance)[1].

What I really really want

Is a data plan where I just pay for a data allowance – say about 15GB/month – and I can get as many SIMs as I need. After all I can’t use all of those devices at once, I only have one pair of eyeballs connected to one brain. Sure if I have a few of them switched on at a time then there’s a certain amount of quiescent data use, but nothing like when I’m actively surfing (and the only thing that uses serious data is big downloads and video).

Of course the devices above marked presently empty are probably seen by the telcos as an opportunity to sell me more contracts rather than use more data or make my life more convenient. The other issue is that each telco will only let me have so many contracts. Do they expect me to swap SIMs around (Android behaves quite badly when you do that)? Or am I expected to buy PAYG packages when I exhaust my ability to get more contracts?

and it’s not just data plans – apps (and content) too

One of the things that I quite like about the Apple ecosystem is that I can buy apps once and then use them on multiple devices. This is fine for the single user use case, and also fine if one person is happy to take pecuniary responsibility for a household of devices. I however have already anticipated trouble ahead as my kids grow up, and if/when tablets become multi user (as I think they should) then it creates some very tricky situations for app billing.

I’ve already hit issues with a device limit on Audible when I tried to install it on my Galaxy Tab (something that wouldn’t happen without silly DRM). I wonder how many other nasty surprises are out there waiting for me?

[1] if you have ACCINT on your bill for £4.17 ex VAT then you might be in the same boat.

Filed under: technology | 3 Comments

Tags: 3, android, app, apps, Audible, contract, data, Galaxy Tab, iPad, mifi, mobile, payg, tariff, telco, Three, vodafone

More Android

This post will likely be trollbait for that special flavour of Apple fanbois and their anti equivalent…

Weekend away

I spent a most enjoyable weekend away at Maker Faire in Newcastle, and I took my iPhone 4 and the San Francisco (ZTE Blade) with me (along with my old Lenovo s10e netbook). The Blade made an excellent MiFi for the trip there and back. Subjectively it was better than the Huawei MiFi that I’ve used before and the Gobi modem in my X201 tablet.

When I was out and about I found that I was mostly reaching for the Blade in preference to the iPhone. Gmail, Twitter, Google Reader, Google Maps (and Streetview) all just seemed better on the Android device – more intuitive, faster, easier. The iPhone was relegated to camera duties, and of course served its purpose as a device for corporate email. One feature on the Blade that I must call out is the predictive text when typing emails – it just works so much better than anything else I’ve experienced before (and makes the smaller touch screen work better than the larger one on the iPhone). On balance I couldn’t disagree more with some that say the Android user experience sucks.

Galaxy Tab

I got back from the weekend away to find a Samsung Galaxy Tab waiting for me at the office (a present from my US colleagues). Sadly it was an AT&T one, so it was once again time for some rooting, unlocking and firmware flashing. Things didn’t go entirely smoothly, so I needed a little patch to make things better.

Over the past week or so I’ve tried to use the Galaxy Tab in place of my laptop (mostly as I have a new corporate build laptop, which is pretty locked down – so no Twitter, personal email or videos). It’s mostly worked out pretty well. I sometimes miss multi tasking (watching videos whilst reading Twitter or Google Reader), though with small and medium sized Android devices at hand I can get along.

Speed is a feature

One of the reasons I’ve found my usual apps (Gmail, Google Reader and Twitter) so much better on the Android devices is the HSDPA support in the hardware – they just make better use of brief periods of occasional connectivity. Android also seems to do a better job of caching stuff – so Google Reader works when my train is in a tunnel in ways it didn’t before (even on my laptop). I guess the flip side is that it uses a fair bit more data, but when I can get 2Gb from Three for £5.11 it’s not bothering me too much. One of the ironies here is that my Android phone makes my iPhone better (when I use it as a hotspot and connect the iPhone by WiFi). It seems crazy that Apple don’t put proper modems in their phones (and I must say I haven’t seen bad battery life on the Blade).

Back in Apple land

The novelty has definitely worn off with my iPhone. Cut the rope – done, Angry birds – done, upgrade to iOS 4.3 – done, ripped off £5 by Vodafone just for trying out the new hotspot feature – done, sick of calls being cut off, and no data coverage – done. Only 21 months to go until I can upgrade to something else…

A few days before I got the Galaxy Tab I ordered an iPad 2, which is now waiting for me at a friend’s in the US. I got the white one (in a vain attempt to make it obvious that it’s the new model). This may have been a mistake – white borders are supposed to be bad for movies (though maybe better for ebooks?). I already wondering if I should have got a WiFi only Xoom (and the new bigger screen Galaxy Tabs look lovely).

Multitasking —> multiuser?

As more tablets and similar devices start to appear in the household I’m increasingly convinced that they should have multi user capabilities. A smartphone may be a personal device, but a tablet is a more social, shareable sort of thing. I want to be able to give these things to my wife and kids, but I don’t necessarily want them using my accounts for stuff (and they will of course want to sign into their own accounts). Of course the manufacturers want to sell more devices (one per person) but is this realistic? My bet is that Google will get this right ahead of Apple, and that it just might be the move that makes them win.

Windows all over again?

The flip side of Android is that it seems to be developing the same security issues as Windows (back in the bad old days). I’ve already had colleagues asking me why the ‘security guy’ favours Android? Part of the answer to that is I know what I’m doing, but I can see a mess developing, and I’d rather not be running a bolt on security suite on my phone/tablet. Google need to partner with (or buy) Veracode or similar to keep bad stuff out of the marketplace.

Filed under: technology | 6 Comments

Tags: android, apple, firmware, Galaxy Tab, google, HSDPA, iPad, iphone, multiuser, root, tablet, Three, unlock, vodafone, ZTE Blade

Android Experimentation

When I started my new job I had two choices for mobile device – a company owned BlackBerry or buy my own iPhone and get company email using Good. I didn’t want to go back to having two phones in my pocket, which would have been necessary if I’d gone down the BlackBerry route (as I wouldn’t be able to install apps or get my personal email on it). I was also pretty sick of the BlackBerry 8900 Curve I’d had for almost two years, so I went down the iPhone route. I’d really quite fancied getting a Nexus S, but with only 16GB on board (and no Micro-SD) it didn’t have the storage I knew I’d need (and although Good runs on Android my new employer has so far only sanctioned the iOS variant).

I still wanted to scratch the Android itch though, and a colleague had suggested getting an Android phone with a data only SIM as an alternative to a MiFi. I already had some suitable SIMs, so all I needed was a handset. For that I wasn’t even tempted by shiny and new; cheap and cheerful was the way to go, and I ordered myself an Orange San Francisco (aka ZTE Blade) – £99.99 new on eBay.

Unlocking

This could not have been easier. I put my IMEI into an online unlock code generator, and followed the remaining instructions that I found here. The Orange SIM that came with it need never have been cracked out of its carrier.

Rooting

I didn’t want the Orange bloatware in my way, and I wanted a newer Android version that supported tethering/hotspot – time to take possession of my phone for some warranty voiding hackery. The first step was to install the Universal Androot app, which also meant downloading Astro File Manager from the Android Market.

When I first ran Universal Androot it said that I already had root, but when I tried to put Recovery Manager on things didn’t go well. When I went back and told Universal Androot to do its thing everything started to work properly.

Recovery Manager and Clockwork

These are the bits that are needed to install new firmware.

First up – recovery manager. I downloaded v0.29 and followed these instructions, though I used it to install Clockwork 3.0.0.6.

With that done I booted the phone into Clockwork by powering on with the volume down button held. I then used Clockwork to wipe the phone and install Android 2.2 (Froyo)

Froyo

There are LOTS of different firmware options out there for the ZTE Blade. When Cynogen Mod (a version of Android 2.3 ‘Gingerbread’) becomes stable on the ZTE Blade I’ll probably move to that, but some research suggested that 2.2 would suit my needs. I went for the FLB-Froyo G2 (version r10b). This involved installing the firmware, an update and then the extras using Clockwork, then rebooting into my shiny new phone OS.

If I was doing it all again…

Which I will be, as I’ve just ordered one for my wife (in White). Then I’d make sure I had all the files that I needed on the Micro-SD before starting. I’d be surprised if it takes me more than a few minutes next time around.

In use

I’m very impressed with the experience. The gmail/calendar/contacts integration is fantastic, and there are certainly features where I think it has the edge over the iPhone 4.

Most importantly it seems to work very well as a 3G-Wifi bridge. I’ll see over the next few days whether it’s any better/worse than the embedded 3G in my laptop that I’m used to using on a daily basis.

Filed under: technology | 4 Comments

Tags: 3G, android, Androot, clockwork, cyanogen, Froyo, hotspot, mifi, Orange, recovery manager, root, San Francisco, unlock, wifi, ZTE Blade

Every hotel room should have one

Last week I was very impressed to find this at my desk in the Westin Jersey City:

and yesterday I found this in the Crowne Plaza Zurich:

NB The D-Link pocket WiFi router being powered by the media bar USB. For some odd reason this hotel doesn’t have WiFi (but thankfully it does have free wired Internet) – so having my own WiFi is handy for my iPod, Blackberry etc. (and surfing away from the desk).

NB The D-Link pocket WiFi router being powered by the media bar USB. For some odd reason this hotel doesn’t have WiFi (but thankfully it does have free wired Internet) – so having my own WiFi is handy for my iPod, Blackberry etc. (and surfing away from the desk).

In the past I’ve often struggled with putting video from my laptop onto a hotel room screen (with connectors either inaccessible or impossible to get at). It’s great to see that hotels are finally getting a clue and making life easy.

Now I must remember to add a VGA cable to my usual travel kit (though I would hope that reception would have some loaners).

Filed under: did_do_better, technology, travel | Leave a Comment

Tags: audio, HDMI, hotel, screen, tv, USB, VGA, video

The return of Mr Nice Guy

As this post hits the wires I’ll be starting induction training for my new job at the other big Swiss bank. Their blogging policy is slightly more liberal than before, but in general it’s back to being nice about every company and individual on the planet because they all could be customers.

I intend to keep writing about techie stuff, and hopefully that still includes gadget reviews and the occasional how to hack around dumb restrictions that get put onto the stuff we buy these days.

Filed under: blogging | 3 Comments

Facebook and Internet Alchemy

This is one of those started as a comment, but really deserves a full post type things…

My comment was in response to JP’s The new new telco where he posits that Facebook could be a very valuable business due to its telco like properties on a global scale. Here’s my original comment:

This is a great counterpoint piece to what I wrote yesterday about why I think Facebook is overvalued.

The thing that’s missing here is something that I call ‘Internet Alchemy’ – the process of turning somebody else’s pile of gold into your pile of nickles. In this case we see two piles of gold – one for the old telcos and another for the new telcos. My conjecture is that Facebook doesn’t get to grab these piles of gold. Internet alchemy will turn them into a pile of nickels, and so there is a lot less cash on the table. The canonical example here is Craigslist. It’s a phenomenally successful firm by any conventional metric, making $100m/yr with around 30 employees, and it has utterly destroyed a print classified business worth orders of magnitude more – Internet alchemy at work.

Of course Facebook is special, and it may yet find a way of making money that none of us have anticipated. But is it really 3.5x more special than Google? I don’t think so. People are calling this bubble 2.0 or whatever because we’re once again seeing a disconnect between cash flows and valuation with no substantive means of support.

Somehow this seemed to set the tone for much of the rest of the discussion there (which is well worth reading) as various people speculated about the size of piles of gold.

Internet alchemy

Definition (for an Internet based startup) – the process of turning somebody else’s pile of gold into your pile of nickles

I’ve been meaning to write about Internet alchemy for over a year. I made a start, but got lost along the way trying to explain why it was something more than just disintermediation.

The Facebook valuation debate has got me thinking about this again, and I think there are a number of other factors (besides disintermediation) that come to bear here, though none of them are new, and I offer no fresh insights:

- Free – people like free stuff. The Internet is full of free stuff. Some say that there’s an expectation that stuff on the Internet is free (at least at the point of consumption[1]). Books have been written on the topic. It’s hard(er) to make money out of a given user population on the Internet when the expected price is free (but you get to reach a much larger population for tiny marginal cost).

- The long tail – the Internet reaches people and places that were previously inaccessible. As the Internet gets to parts of the globe that weren’t previously connected it’s expanding into what bankers call ’emerging markets’, and what the rest of us might call ‘poor people’. There are lots of nickles and dimes to be collected from the long tail, but its very nature is that there aren’t huge piles of cash.

If we look at how the Internet is disrupting traditional businesses and markets then I think we can find examples of Internet Alchemy all over the place. It’s probably also a factor in the ‘jobless recovery‘ – new businesses are emerging that destroy old businesses, but the economic value changes dramatically in the transition.

Why does this matter for Facebook?

Any traditional business with around 600m customers would be making an infeasibly large amount of money, and clearly the $50Bn (or larger) valuation being placed on facebook suggests an expectation from their (more recent) investors that the monetisation plan will come along in due course to turn those customers into cash. My conjecture is that Facebook will be a victim of Internet alchemy, that there are no pots of gold associated with those users, only a pile of nickles. I expect that the Facebook team already know this, but at this stage they’re along for the ride as other people try to get rich off their work.

If you can see some piles of gold that Facebook might grab that you think I’ve overlooked then please let me know?

Notes

[1] Though I love the statement that ‘if you’re not paying for it; you are the product‘

Filed under: wibble | Leave a Comment

Tags: alchemy, business model, disintermediation, Facebook, free, Internet, long tail

There’s a passage on governance in Clay Shirky’s Cognitive Surplus that I really like:

‘Groups tolerate governance, which is by definition a set of restrictions, only after enough value has accumulated to make the burden worthwhile. Since that value builds up only over time, the burden of the rules has to follow, not lead.‘

It explains better than I ever could myself why we were on a path to disaster with SOA governance for enterprise IT circa 2004. The governance cart was being put before the SOA horse.

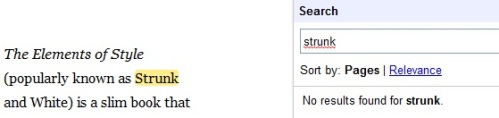

I tried to find this passage in my Google Books copy of Cognitive Surplus by searching for governance. Surprisingly it returned ‘No results found for governance‘. I then grabbed my Kindle (where I had put a note against this passage) and found a nearby word to search for – I chose ‘Strunk’. Again I got ‘No results found for strunk‘. Yet when I found the passage (the hard way) I see ‘Strunk’ highlighted on the page:

Anybody know what’s going wrong here?

Filed under: could_do_better | Leave a Comment

Tags: books, ebook, fail, google, governance, search, SOA

The wrong sort of radio

This post is about the madness of corporate web filters in the age of ubiquitous consumer devices with Internet connectivity.

I typically see three types of connectivity in any given corporate setting:

- The company network. Usually wired, but sometimes with a wireless adjunct, this network offers the same liberty as an oppressive Middle East regimes[1]. This is a network where you can’t use social networks, check your webmail or see pictures (or business charts) uploaded by others. This network has been locked down for your own protection, and for the protection of the company.

- Guest WiFi. When coffee shops started becoming a better place for business than company meeting rooms something had to be done, and guest WiFi was that something. Sadly in many cases it’s locked down with many of the same measures and policies as the corporate network[2,3] – the only real change is that ‘foreign’ devices are allowed to connect.

- Mobile networks. Increasingly these come by default with some degree of nannyistic filtering, but in my experience it’s pretty benign – you can go to the places and ports that you want to and use the services that live there.

Trying to control where radio waves go

In 1 and 2 the legal and compliance department seeks to control what happens over the radio waves, in 3 they cannot – hence the title of this post.

I was recently at an event run by a large security software and solutions vendor where they said that ‘they too were having trouble with this stuff’ (referring to executives using iPads) so they’d had to ‘turn off some of the WiFi’. So what – the executives couldn’t afford the 3G iPad?

The nonsense of inconveniencing your own people

This whole thing is nonsense. Companies can’t control what employees access on the Internet, because nobody wants to become like a top secret military installation and take everybody’s phone away from them at the gate. The reality is that employees will have iPhones and iPads and other smartphones and other tablets and netbooks with 3G cards and MiFis and Kindle 3Gs and all manner of other stuff that can get to a (mostly) unfiltered web. For sure you can make life less convenient for your own people by making too many of them share a limited pool of bandwidth[4], but if you’re worried about people wasting time on social networking or personal email then do you really want to make it slower?

Concerns

At this point it’s probably worth unpacking some of the concerns:

Security

For a very long time we’ve had corporate networks that follow a confectionery design pattern – hard on the outside, soft in the middle. The whole point of hard on the inside is to stop damage to soft in the middle. Despite the best efforts of the Jericho Forum very few organisations have done deperimiterisation (or even my preferred ‘reperimiterisation’), which leaves them stuck with a model where you can only allow approved devices, software etc. An associated concern is that browsing the seedier parts of the Internet brings with it infections that may not be spotted by anti virus software and similar defences.

Security is probably a valid reason for the behaviour we see on company networks, but doesn’t justify controls on guest/employee WiFi, and of course the security guys don’t really have any say on what happens on mobile networks.

Not Safe For Work (NSFW)

One of the initial reasons for introducing web filters was a desire by HR to block porn[5]. I don’t ever recall the epidemic of people surfing XXX rated material (and upsetting their co workers by doing so), but clearly enough people thought this was a problem and were willing to spend money on it[6].

What’s curious is that the arrival of broad(ish)band connected mobile consumer Internet devices with no filters hasn’t caused some catastrophic outbreak of inappropriate material being poked in the faces of inappropriate people. It looks like people are able to behave like mature adults after all.

Of course filters don’t always work, and I’ve seen an instance or two of objectionable spam make their way through. Somehow this is more of a problem when using Outlook (which renders images by default) rather than Gmail (which doesn’t).

The NSFW argument doesn’t hold up in my view, and HR were probably suckered into playing the paternalist in order to justify buying a bunch of kit that some IT folk wanted for other purposes.

Time is money

This is the one where employees shouldn’t be spending their valuable (company paid for) time checking their personal email and chatting to their friends on Facebook/Twitter/AIM or whatever the next flavour of the month is.

Firstly this expresses a very Victorian work ethic towards time management (that my US cousins still seem all too attached to). As we move from the industrial age to the information age we’re slowly seeing a shift from clocking in/out towards flexibility and ‘work/life balance’, but whilst we still have people around that we pay by the day (or even hour) then we will continue to fool ourselves that time is valuable rather than outcome.

I guess the quid pro quo here is that my wife hates me using my Blackberry at home just as much as most companies would hate me using Facebook at work (even if I’m using the Blackberry to check Facebook).

The information age is changing the nature of work and how it interacts with time. The productivity of ‘Knowledge workers’ can vary dramatically, with short bursts of great output set in a broader context of information gathering (and many seemingly aimless conference calls).

Secondly there’s the assumption that social interaction is somehow utterly unrelated to work. That people shouldn’t be able to ask their ‘friends’ for help.

Once again we see that employees are using this stuff anyway (at work) on their own devices, and the time that’s being ‘wasted’ isn’t hurting.

The common sense approach

What I think companies should be doing here is protecting their corporate networks where that is still necessary (and moving towards reperimiterisation around the data centre core) and offering their employees, partners, clients and other parties an otherwise unfettered path to the Internet (via unfiltered WiFi). This should simply be a question of cost and convenience where for very good infrastructure reasons mobile data costs more (and is often less convenient) than WiFi built on a wired bearer.

Why is this so hard?

Notes

[1] Hardly surprising as the companies that sell lists of stuff to be blocked have these countries as their primary customers, and business users just tag along for the ride.

[2] To stop employees from sidestepping the policies on the corporate network, and doing the stuff that they want to do on the Internet.

[3] I’ve come across some cases where companies have invited in telcos to provide WiFi. I think this is a win-win – guests (and employees) get the connectivity that they want (and more reliably than a mobile connection), the telco gets paid for an hour/day/longer subscription, and the legal and compliance people get to sleep at night knowing that they’ve passed a potential liability on to a third party. I’ve also come across some legal and compliance people (mostly in the US) who take the view that this can’t be done because liability for what happens (on the Internet) within the boundary of a company’s premises can’t be passed on. Don’t ask me what happens if you have an on site Starbucks in a leased building.

[4] Canary Wharf is an awful place for mobile devices given the poor ratio of infrastructure to people based there.

[5] I recall a frustrated network engineer one day recounting how he’d presented a business case to the executive board and they come back at him with ‘you want us to spend $5m on a better porn filter?’ – clearly there was some kind of communication issue and somebody was missing the point.

[6] One of the insane arguments here is that people surfing Internet porn at work were costing the company money (by using the precious resource of their Internet connection) and therefore it was worth spending even more on web filters to stop this from happening.

Filed under: security, technology | 5 Comments

Tags: 3G, data, filter, filtering, HR, mobile, policy, security, social, time, web, wifi

I was very pleased to see Google’s announcement yesterday about Email authentication using DKIM now available to all Google Apps domains[1,2]. DKIM is an important weapon in the war on spam, and may well be crucial to stopping email from slipping into irrelevance. Of course this may just make the spammers go after our Google Apps credentials, but we have two factor authentication (at least for GAPE/GABE) as a means to fight back.

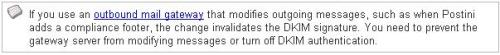

Sadly there’s a fly in the ointment, and once again it’s with Postini:

At this point I’m pretty much ready to give up on Postini. It’s anti spam features don’t seem to me to be that much better than native Gmail/GApps. It’s confusing for my users to get a daily quarantine message from Postini and stuff in their spam folders on GApps (usually it’s bacn in both – I see very little real spam in either). The only thing that we use it for that adds any value is adding a compliance footer, but now that stops us from having DKIM.

Of course one might expect a high end product like Postini to have DKIM support in its own right. Sadly this is where Postini is too ‘enterprisey'[3].

So… compliance footers with a link to some legal boilerplate that nobody bothers to read[4], or DKIM so that our email stands a better chance of actually reaching its intended recipient? Not such a hard choice really – seems like I have some GApps domain admin work to do.

PS Google – it would be great if you could make the labs feature ‘Authentication icon for verified senders’ work for all DKIM authenticated email and not just PayPal and eBay.

[1] DKIM has been available in regular Gmail for some time.

[2] Though I’m disappointed to see that it’s not yet available for thestateofme.com (whilst I have been able to set it up for some other domains where I use Google Apps).

update 8 Jan – it turned out that I needed to turn on ‘Next Generation’ for the Control Panel in Domain Settings – General for the DKIM options to show up.

[3] Don Box – So Long, 2006 ‘The blogosphere embraced the term “enterprisey” to describe the lack of quality that previously had no name’.

[4] I know from the web logs.

Filed under: could_do_better, technology | 5 Comments

Tags: DKIM, GABE, GAPE, gapps, google, Google Apps, Postini, spam